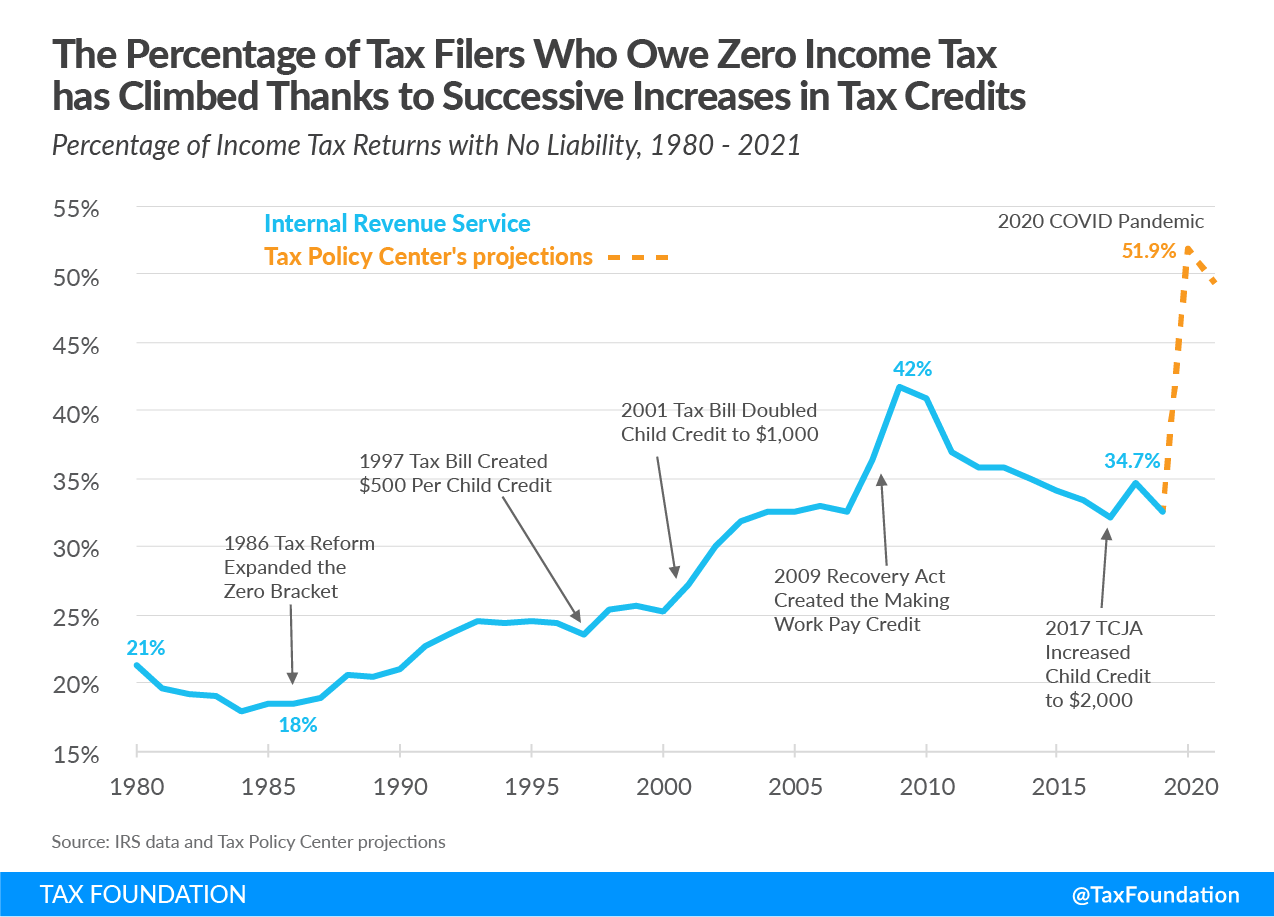

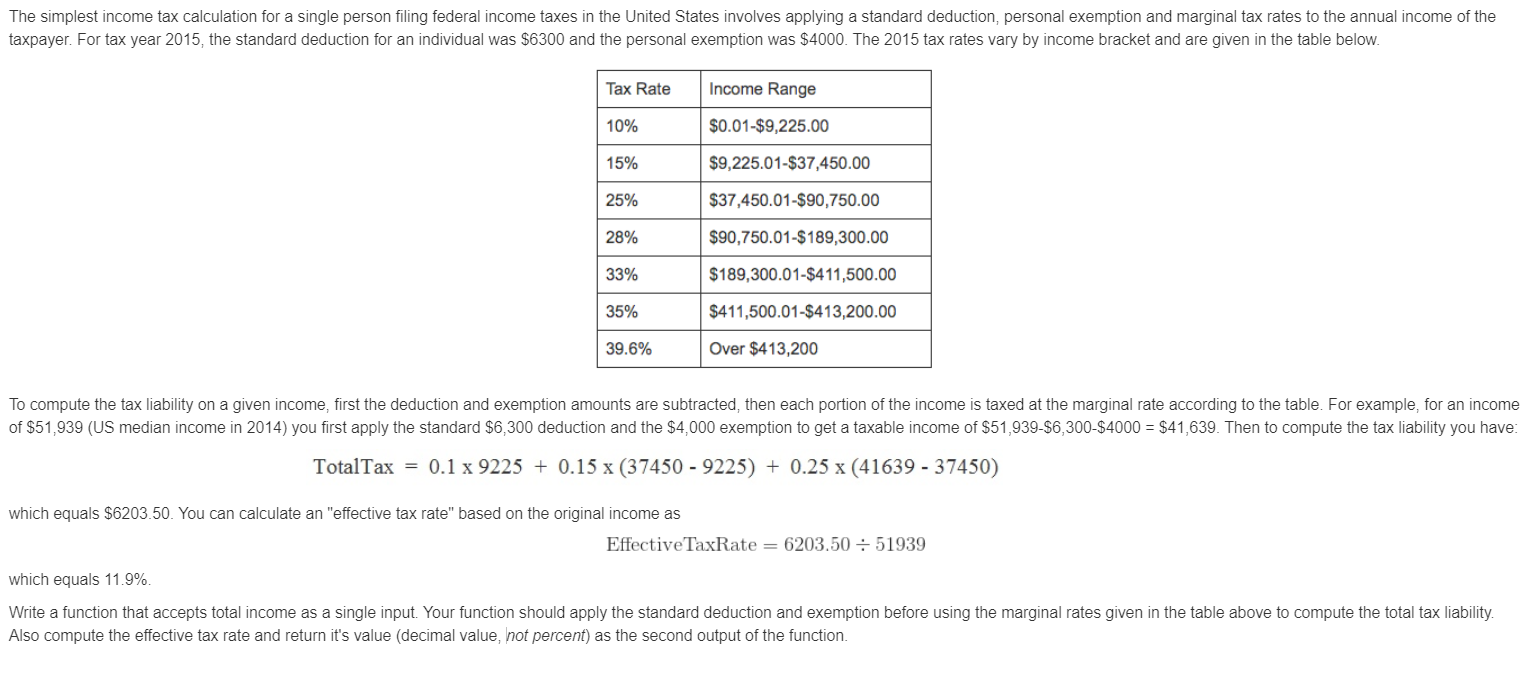

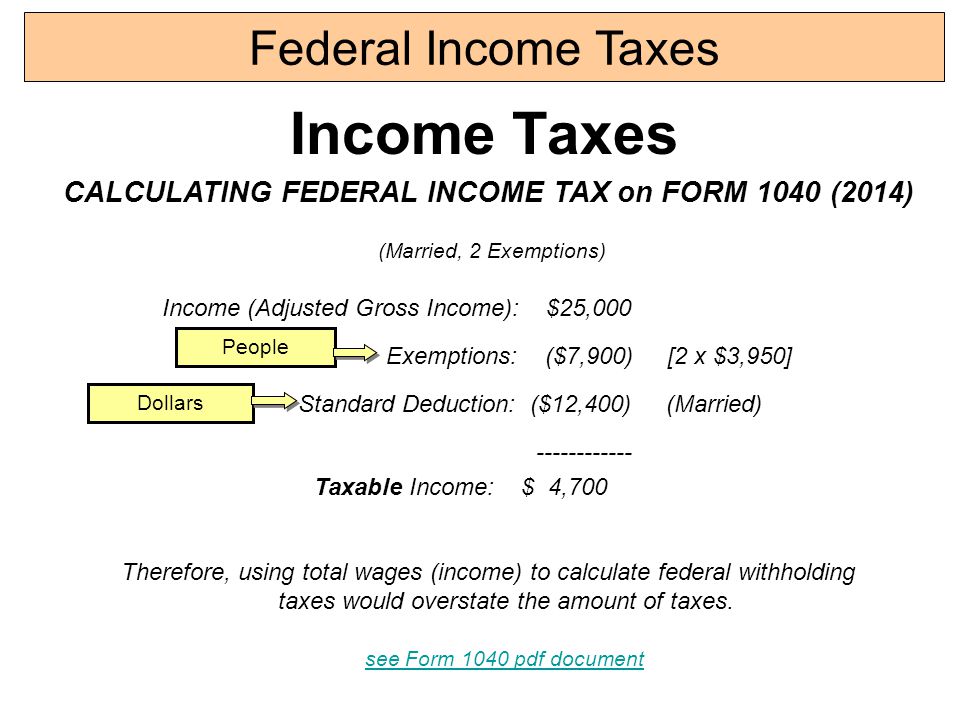

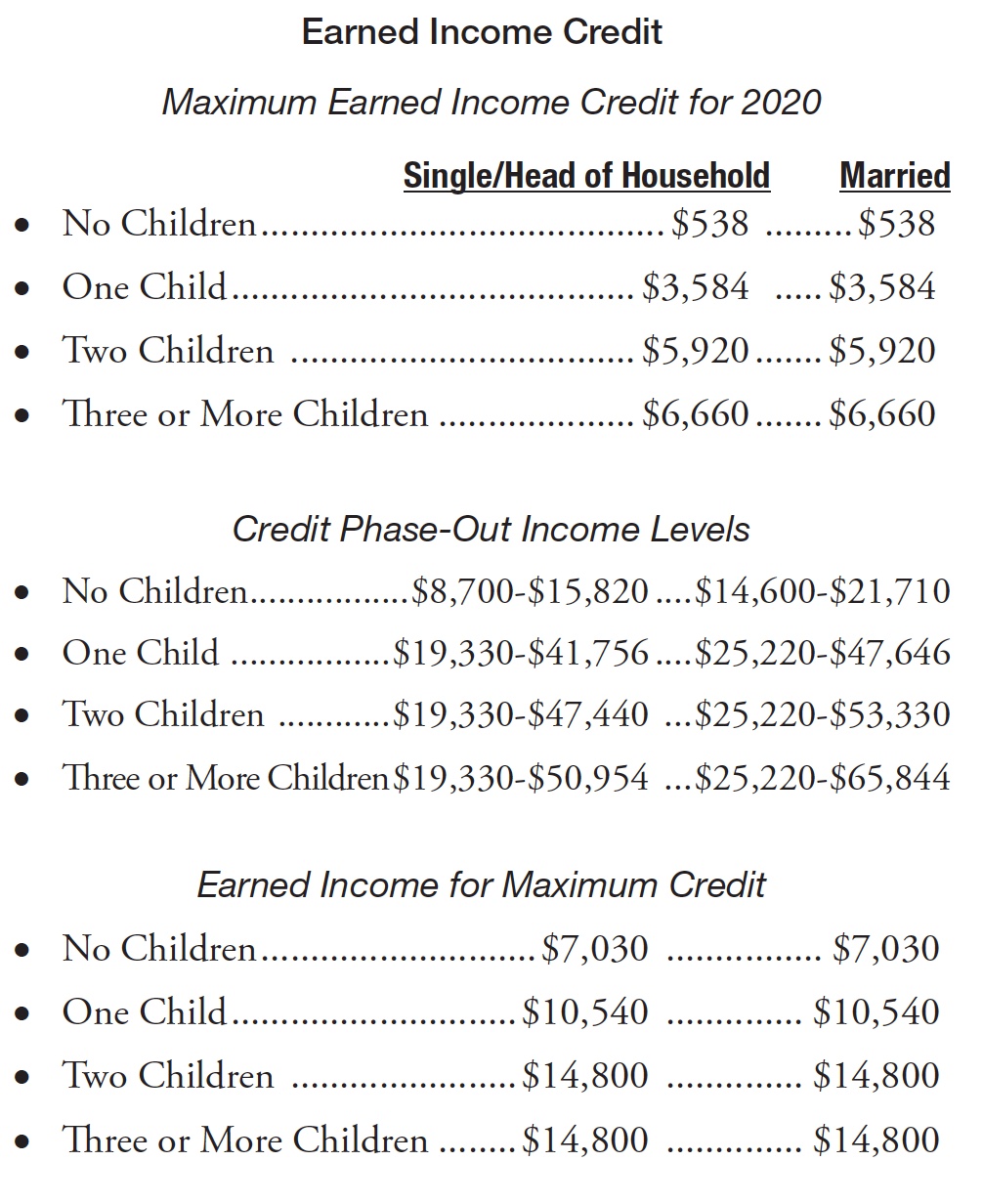

Michigan Family Law Support - Feb 2020 : 2020 Federal Income Tax Rates & Brackets, Etc., and 2020 Michigan Income Tax Rate and Personal Exemption Deduction - Joseph W. Cunningham, JD, CPA, PC

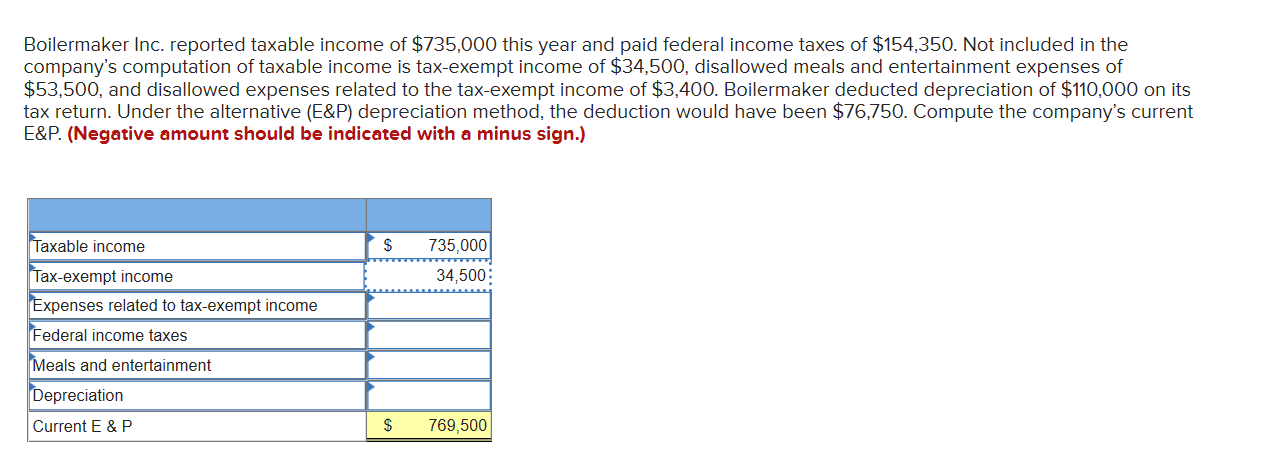

Tax Compliance: Thousands of Organizations Exempt from Federal Income Tax Owe Nearly $1 Billion in Payroll and Other Taxes - UNT Digital Library